Today I’m going to talk to you about a topic I love…. getting paid!

Today I’m going to talk to you about a topic I love…. getting paid!

Not to be confused with how to get paid but what to do once you do get paid.

Let’s talk about paying yourself.

How much you should get paid.

Should you pay yourself?

What about taxes?

It’s April and I paid my taxes today. It didn’t make me want to cry because I think I finally have this stuff figured out! It’s been a lot of trial and error to get here so maybe I can help you!

I’ve been doing this self employed thing for most of my adult life. That’s about 15 years if you must know 😉 I collected my first year of self employment income waaay back in 2002. I knew nothing about well…nothing.

What I found out quickly is that no one else pays your tax for you.

You actually have to be disciplined enough to set it aside! Ok, so I actually knew this but I didn’t know how much or how to go about doing that.

So I met with an accountant.

The sad story is he steered me wrong. So wrong. The problem is, I met with him at tax time but my previous year’s income only included 2 months. Somehow this tax professional didn’t understand me or believe me when I projected the next years income and assured me not to worry about tax as my husband’s with-holdings would cover both of us.

He was wrong.

I still remember exactly where I was in my house when I got the phone call from the accountant’s office about my tax returns the following year. I was expecting a refund.. cuz duh… doesn’t everyone get a refund…;)

Instead I received the news that I owed the IRS more than $5000.

We were around 22 years old (i.e. not very smart with our money), newlyweds with a new baby and a new house. We didn’t have $5000 in the bank to pay it. We had to take out a second mortgage to cover it.

I’ve shared this story with very few people because it’s embarrassing. But it was 15+ years ago so I should probably let it go 😉

I didn’t mean to start out with doom and gloom especially about something as awesome as GETTING PAID! By sharing that story though it might stress the importance of figuring this stuff out. I’ll save you a lot of heart ache and offer some easy things you can do so that is not your story.

The silver lining in that mistake is that I knew I had to learn this stuff and started reading and researching to prevent it from ever happening again.

Clearly I’m not a tax professional, I’m not a business lawyer, I’m not an accountant so you really need to go see one of those professionals for specific advice. (Just pick a good one!)

I’ll walk you through some of these topics:

- When should you start paying yourself

- How should you pay yourself

- How much should you pay yourself

- How often should you pay yourself

- Checking/ Savings accounts I think everyone should have

Guys, this is all based on what I currently do. It works for me. It might not work for you or it might be just the thing you need to finally feel like you are getting paid for the hard work you are doing.

This is all a combination of the many financial books, videos and podcasts I’ve listened to over the years. It’s an evolving process and something I continue to finesse.

When I started paying myself

There are two schools of thought on getting paid as an entrepreneur.

Immediately or in a few years when your business starts making money.

So one school of thought is that most self employed entrepreneurs don’t pay themselves for the first year or two. I guess because they don’t expect to earn much or they are reinvesting it back into the business.

The other school of thought is that as soon as you start making money, you should get paid.

I think there can be value in both. When I started my photography business I didn’t pay myself for the first year or two. I was profitable on year one so that wasn’t the problem.

I’m pretty sure I didn’t because I didn’t know how! (Spoiler Alert: Take a percentage.) At that point it was a side hustle so I wasn’t depending on the income. I certainly pulled money out from time to time but not on a regular basis or with intention.

This turned out to be a good thing for me because somewhere between year 2 – 3 I decided to find a small studio space. I was able to invest in a space, decorate it and pay rent because I had money sitting there to re-invest. I think the space adds a lot of value to my business and was worth it. Truthfully, I’m sure I could still have made it happen if I had started paying myself on day one especially because I now account for these things. It might have taken a little more time though.

Around year 3 is when I systematically started paying myself. My husband was thankful for that..lol. He saw how hard I was working so finally our family was benefiting from that hard work.

I think you should pay yourself right away even if it’s just a small percentage. Start small and then increase as your business grows.

By the time I started my quilting business I knew how to pay myself and started doing so immediately.

How I pay myself

I’m a huge fan of systematically paying yourself. That means paying yourself a percentage on a regular basis.

And not just paying yourself, but also setting aside a percentage of the income for other things such as:

- taxes

- savings

- operations

I learned this method of paying yourself from Mike Michalowicz of Profit First. I watched his Creative Live class and read his book.

I pay myself once or twice a month. Either the last day of the month or the 15th and the last day of the month.

What does this look like…?

All money I take in goes directly into my business checking account. Everything is filtered through that account.

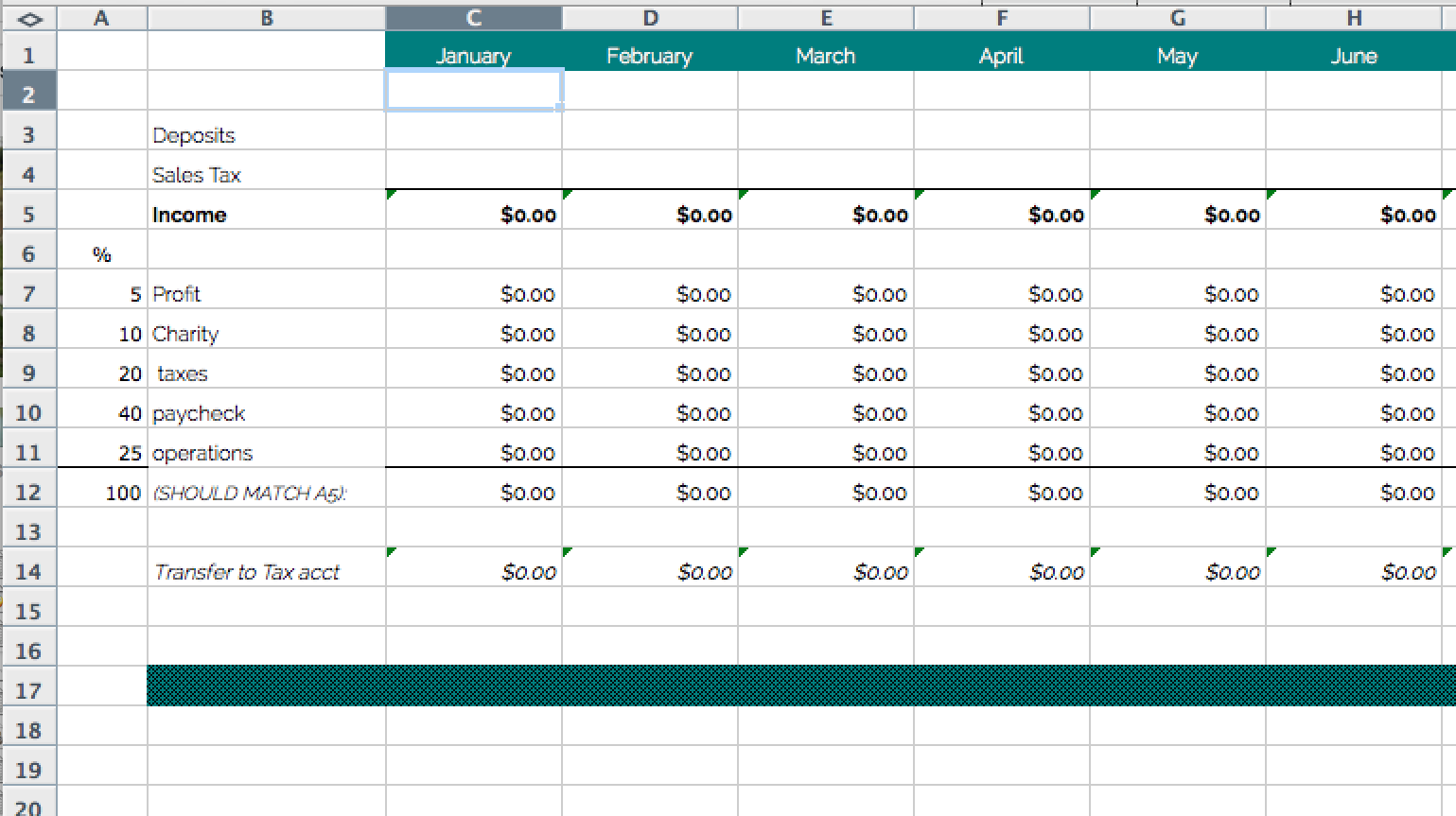

When it’s time to pay myself I use an excel spreadsheet to distribute my income for the month. I do alter percentages from year to year when my goals change. Here is what it might look like:

5% – Business Savings Account

20% – Tax Account

40% – Paycheck (transfer to personal accounts)

35% – stays in account for operations

____

100%

The idea is that whatever your accounts of choice are the percentage equals 100%.

You might change the percentages around a bit and add a charity percentage. Or you might have more overhead and need more than 35% to operate your business… or less if you are lucky!

A good rule of thumb for most people will be setting aside at least 20% for taxes. If you can’t stomach a tax bill, I urge you to meet with a professional now so they can give you a more accurate withholding percentage. The idea is that you are saving 20% of your gross income so it gets most people pretty close to what they are actually taxed on. Obviously, this can vary wildly from business to business. If you have very little expenses or are in a higher tax bracket 20% may not be enough.

Click on the image below to download this excel spreadsheet!

Customize it to your needs and start taking a paycheck!

Whats with all the accounts?

So yep, I have like a million accounts. Ha. Not quite but I do have quite a few! It’s so easy to open multiple accounts these days and with online banking I can easily transfer between these accounts.

I have a business checking account. All income is deposited into this account. I pay all business related bills and expenses from this account.

I have a business savings account. Imagine that your business actually has a savings account! How awesome would that feel!? I use this account as an emergency fund for my business but mostly its a rainy day fund. I pull from it for things like houseboat rentals on Airbnb 😉 It’s just another way to save and make sure I’m getting paid for the work I put in.

I have a tax account. This is another checking account I call my tax account. Every month 20% off my gross income goes into this account. Sales tax also goes into this account on a monthly basis. I pay my quarterly taxes from this account and pay the end of the year tax bill from this account. If you do nothing else, set up this account!! Paying taxes is not stressful at all when it’s been set aside all year long. And if at the end of the year there’s something left, consider it your bonus!

I have a charity account. I systemically put money into this account for the purpose of charitable giving.

And those are just accounts for my business! Just today I set up another personal savings account because my boy and I have big dreams and we are determined to make them happen 🙂

Why I think you should have consistency

Setting up this system has given me so much freedom! Seriously!

I get paid.

Like an actual paycheck, paid. Every. Single. Month. Some months it’s much bigger than others. If you prefer your monthly paycheck be the same every month I would still follow a similar system. Just add another checking or savings account to dump your paycheck percentage into and then pull your paycheck from that.

I don’t overspend on expenses.

There is a myth I want to dispel right now. Having so many expenses that you don’t have to pay tax is NOT a good thing. I’m proud of my tax bill (weird, right!?) because it means I made a PROFIT. I don’t spend every single dime I take in on my business. By paying myself monthly, I know my spending is under control because of the limited funds left in my business checking account. Remember, at the end of every month only operations money is still there.

Paying taxes is painless

I think that says it all right there 😉 Trust me when I say I know the pain of scary tax bills. I’ve had plenty of them.

I have a purposeful amount to spend on my business every month.

Knowing that every month there is something there to spend on the business is very freeing. Some months are a little tighter than others but basic monthly expenses can be paid.

It makes my husband happy.

Ha. Your family needs to benefit from your hustle! When my business actually gives me a paycheck the husband is happy to let me continue on my crazy entrepreneurial journey 😉 He will support you when you want to quit a long term steady job because he knows you have it together enough to continue helping to support the family 😉

Man, I tend to get long winded with these topics. I guess I have so much to say about it all!

Change your habits and make it happen!

Don’t know where to start? I’ll sum it up for you here if this is something you feel your business needs.

Open your accounts

- Open a business checking

- Open a business savings

- Open a checking or savings account to hold taxes

- Open any other accounts you want to distribute your income into

Set up an excel spreadsheet (download one here!) or use some fancy software and commit to distributing your income monthly every single month.

- Add up all gross income for the month

- Distribute to your other accounts by the percentages you choose

And now smile because you are well on your way to rocking your creative business.

I now know not just how much money I make each year, but how much I need to make each year to reach my salary goals.

Let me know if you found any of this helpful or if you have any tips to include!